Video Identification in the Loan Process

In today’s digital age, the process of obtaining installment loans has evolved to incorporate innovative methods such as video identification. This introductory section aims to provide an overview of video identification, its significance in the loan process, and a glimpse into identity verification video calls.

Inhaltsverzeichnis / Table of Contents

- 1 What is Video Identification?

- 2 How Video Identification Enhances Identity Verification

- 3 Legal and Regulatory Considerations for Video Identification in the US

- 4 Advantages of Using Video Identification in Loan Applications

- 5 Implementing Video Identification in the Loan Industry

- 6 The Integration of Video Identification Technologies by Lenders

- 7 User Experience and Security Features of Identity Verification Video Calls

- 8 Case Studies of Successful Implementation of Video Identification in Loan Processes

- 9 What are Best Practices for Conducting Identity Verification Video Calls?

- 10 How to Prepare Applicants for the Video Identification Process

- 11 Conducting Effective Video Calls for Identity Verification

- 12 Ensuring Compliance and Data Security During Video Identification

- 13 Challenges and Solutions in Video Identification for Loans

- 14 Addressing Privacy Concerns and Data Protection

- 15 Tips for Overcoming Technical Challenges in Video Identification Processes

- 16 Strategies for Improving User Adoption of Video Identification Methods

- 17 Future Trends and Innovations in Video Identification for Loans

- 18 The Potential Impact of Artificial Intelligence and Machine Learning

What is Video Identification?

Video identification, also known as video verification or video KYC (Know Your Customer), is a method used by financial institutions and lenders to remotely verify the identity of loan applicants. Through live video calls, applicants can authenticate their identity by presenting their identification documents and answering security questions.

Importance of Video Identification in the Loan Process

Video identification plays a crucial role in streamlining the loan application process while ensuring compliance with regulatory requirements. By leveraging video technology, lenders can enhance security measures and mitigate the risk of identity theft and fraudulent activities. Additionally, video identification offers a convenient and efficient alternative to traditional in-person verification methods, allowing borrowers to complete the verification process from the comfort of their own homes.

Overview of Identity Verification Video Call

An identity verification video call involves a real-time interaction between the loan applicant and a representative from the lending institution. During the video call, the applicant is required to present their identification documents, such as a driver’s license or passport, while simultaneously answering security questions to confirm their identity. The lender’s representative verifies the authenticity of the documents and assesses the applicant’s identity based on the information provided during the call.

Through the use of video identification and identity verification video calls, lenders can expedite the loan approval process, reduce the risk of fraud, and enhance the overall borrower experience. As the financial industry continues to embrace digital transformation, video identification emerges as a valuable tool for ensuring secure and efficient loan transactions.

The Role of Video Identification in the Loan Application Process

Video identification plays a pivotal role in modernizing and securing the loan application process. This section delves into how video identification enhances identity verification, the legal and regulatory considerations surrounding its implementation in the US, and the numerous advantages it offers in loan applications.

How Video Identification Enhances Identity Verification

Video identification revolutionizes identity verification by providing a robust and secure method for lenders to confirm the identity of loan applicants remotely. Through live video calls, applicants are required to present their identification documents and engage in real-time interactions with the lender’s representative. This process allows for a thorough examination of the documents and enables the lender to verify the authenticity of the applicant’s identity, significantly reducing the risk of fraudulent activities.

Legal and Regulatory Considerations for Video Identification in the US

In the US, the implementation of video identification in the loan application process is subject to legal and regulatory considerations. Financial institutions and lenders must adhere to stringent compliance requirements outlined by regulatory bodies such as the Consumer Financial Protection Bureau (CFPB) and the Federal Trade Commission (FTC). These regulations govern the use of personal data, privacy protection, and the verification process to ensure that video identification methods comply with industry standards and safeguard consumer interests.

The regulations set forth by these agencies govern various aspects of the loan application process, including the collection, storage, and usage of personal data obtained through video identification. Financial institutions must adhere to specific guidelines to safeguard consumer privacy and prevent the unauthorized disclosure or misuse of personal information.

Moreover, these regulations outline standards for the verification process itself to ensure its accuracy, reliability, and security. Financial institutions must implement robust identity verification procedures during video identification calls to confirm the authenticity of applicants’ identities and prevent identity theft or fraud.

Compliance with these regulations is essential for financial institutions and lenders to maintain the trust and confidence of consumers and uphold their legal obligations. Failure to comply with regulatory requirements can result in severe penalties, fines, and reputational damage for the institution.

Therefore, financial institutions invest significant resources in ensuring that their video identification methods adhere to industry standards and safeguard consumer interests. This includes implementing robust data protection measures, conducting regular audits and assessments, and providing comprehensive training to employees involved in the verification process.

Advantages of Using Video Identification in Loan Applications

The adoption of video identification offers numerous advantages for both lenders and borrowers in the loan application process. For lenders, video identification streamlines identity verification procedures, reduces operational costs associated with in-person verification, and enhances compliance with regulatory requirements. Additionally, video identification enhances the overall borrower experience by providing a convenient and efficient method for completing the verification process remotely.

Borrowers benefit from the convenience of conducting identity verification from the comfort of their own homes, eliminating the need for physical visits to the lender’s office and expediting the loan approval process. Video identification serves as a powerful tool for enhancing identity verification in the loan application process. By leveraging live video calls, lenders can ensure the authenticity of applicants’ identities while complying with legal and regulatory requirements. The adoption of video identification offers a range of benefits for both lenders and borrowers, making it a valuable asset in modernizing and securing loan applications.

Implementing Video Identification in the Loan Industry

As the financial industry continues to embrace digital transformation, the integration of video identification technologies in the loan application process has become increasingly prevalent. This section explores how lenders are adopting video identification, the user experience and security features of identity verification video calls, and case studies highlighting successful implementations in loan processes.

The Integration of Video Identification Technologies by Lenders

Lenders are leveraging advanced video identification technologies to streamline the loan application process and enhance security measures. By integrating video identification solutions into their existing systems, lenders can conduct identity verification seamlessly during the application process. These technologies utilize real-time video calls to authenticate applicants’ identities, allowing lenders to verify documents and conduct face-to-face interactions remotely.

The adoption of video identification technologies enables lenders to expedite the verification process, reduce manual errors, and enhance compliance with regulatory requirements. Also, these technologies offer a convenient and accessible solution for borrowers, eliminating the need for physical visits to the lender’s office and providing a seamless digital experience.

User Experience and Security Features of Identity Verification Video Calls

Identity verification video calls prioritize both user experience and security to ensure a seamless and trustworthy process for borrowers. These video calls are designed to be user-friendly, with intuitive interfaces that guide applicants through the verification process step-by-step. You can easily upload your identification documents, engage in live video calls with the lender’s representative, and complete the verification process within minutes.

Additionally, identity verification video calls incorporate robust security features to protect sensitive information and prevent fraudulent activities. Encryption protocols and secure data transmission ensure that personal data shared during the video call remains confidential and protected from unauthorized access. Not to mention, multi-factor authentication methods, such as biometric verification and PIN codes, add an extra layer of security to verify the identity of applicants.

Case Studies of Successful Implementation of Video Identification in Loan Processes

Several case studies demonstrate the successful implementation of video identification in loan processes, showcasing the tangible benefits for both lenders and borrowers.

Video Identification Case 1:

For example, a leading financial institution implemented video identification technology in its loan application process, resulting in a significant reduction in application processing times and an increase in customer satisfaction.

Video Identification Case 2:

Another case study highlights a regional lender that adopted video identification to comply with regulatory requirements while enhancing customer experience. By integrating video identification solutions, the lender improved the efficiency of identity verification, minimized the risk of fraud, and streamlined the loan approval process for borrowers.

Overall, these case studies illustrate the transformative impact of video identification on loan processes, emphasizing its role in enhancing efficiency, security, and customer experience in the financial industry.

What are Best Practices for Conducting Identity Verification Video Calls?

Incorporating video identification into the loan application process requires adherence to best practices to ensure efficiency, effectiveness, and security. This section outlines key practices for conducting identity verification video calls, including preparing applicants, conducting effective calls, and ensuring compliance and data security.

How to Prepare Applicants for the Video Identification Process

-

Clear Communication

Prior to the video call, provide applicants with clear instructions and expectations regarding the video identification process. Communicate the purpose of the call, the documents required for verification, and any specific guidelines or procedures they need to follow.

-

Technical Requirements

Ensure applicants have access to the necessary technology and a stable internet connection for conducting the video call. Provide guidance on compatible devices, recommended browsers, and troubleshooting steps to address any technical issues that may arise.

-

Documentation Preparation

Advise applicants to have their identification documents ready and accessible during the video call. Encourage them to ensure the documents are valid, legible, and unaltered to facilitate smooth verification.

Conducting Effective Video Calls for Identity Verification

-

Observe Professional Conduct

Lenders and representatives conducting the video calls should maintain a professional demeanor and create a welcoming environment for applicants. Establish rapport and communicate clearly throughout the verification process to instill confidence and trust.

-

Ensure Thorough Verification

Utilize the video call to verify the authenticity of the applicant’s identification documents and confirm their identity visually. Pay attention to details such as facial features, gestures, and document details to ensure accuracy and prevent fraudulent attempts.

-

Engage Applicants

Encourage active participation from applicants during the video call to facilitate a collaborative verification process. Also, prompt them to present their identification documents, answer security questions, and provide additional information as needed for verification purposes.

Ensuring Compliance and Data Security During Video Identification

-

Regulatory Compliance

Adhere to regulatory guidelines and standards, such as those outlined by the Consumer Financial Protection Bureau (CFPB) and the Federal Trade Commission (FTC), when conducting identity verification video calls. Ensure compliance with data protection laws and privacy regulations to safeguard applicant information.

-

Secure Communication

Utilize secure communication channels and encryption protocols to protect sensitive data transmitted during the video call. Implement robust authentication measures to verify the identities of both parties and prevent unauthorized access to confidential information.

-

Data Retention Policies

Establish clear data retention policies and procedures for storing video identification records in compliance with regulatory requirements. Implement secure storage solutions and access controls to safeguard applicant data and mitigate the risk of unauthorized disclosure or misuse.

By following these best practices for conducting identity verification video calls, lenders can enhance the efficiency, accuracy, and security of the loan application process while providing a positive experience for applicants.

Challenges and Solutions in Video Identification for Loans

While video identification offers numerous benefits in the loan application process, it also presents challenges that need to be addressed effectively. This section explores common challenges and presents solutions to enhance the effectiveness and adoption of video identification methods.

Addressing Privacy Concerns and Data Protection

In an era where personal data protection is paramount, lenders are harnessing innovative technologies like video identification to streamline the loan application process while ensuring the utmost security for applicants’ sensitive information. However, as with any advancement, concerns about privacy and data protection loom large.

Let’s delve into the intricate world of video identification for loan processing, exploring the strategies and solutions to address privacy concerns and safeguard applicant data effectively.

-

Transparency and Consent

To address privacy concerns, lenders must ensure transparency in the video identification process. Clearly communicate how applicant data will be collected, processed, and stored, and obtain explicit consent before initiating the video call.

-

Data Encryption and Security

Implement robust encryption protocols and security measures to protect sensitive applicant data transmitted during the video call. Adhere to data protection regulations and industry standards to safeguard privacy and prevent unauthorized access or disclosure.

-

Compliance with Regulations

Stay updated on regulatory requirements related to data protection and privacy, such as the General Data Protection Regulation (GDPR) in the EU or the California Consumer Privacy Act (CCPA) in the US. Ensure compliance with relevant laws and regulations to mitigate privacy risks and maintain trust with applicants.

Tips for Overcoming Technical Challenges in Video Identification Processes

-

Technical Support and Assistance

Provide comprehensive technical support and assistance to applicants to address any issues or challenges encountered during the video identification process. Offer troubleshooting guidance and ensure accessibility for individuals with varying levels of technical proficiency.

-

Compatibility and Accessibility

Ensure that the video identification platform is compatible with a wide range of devices and operating systems to accommodate diverse applicant preferences. Optimize the user interface for accessibility and ease of use to minimize technical barriers and enhance user experience.

-

Continuous Improvement

Regularly assess and update the video identification process to address technical challenges and optimize performance. Gather feedback from applicants and stakeholders to identify areas for improvement and implement enhancements to streamline the process.

Strategies for Improving User Adoption of Video Identification Methods

-

Education and Training

Provide comprehensive education and training resources to applicants to familiarize them with the video identification process. Offer tutorials, FAQs, and instructional materials to guide applicants through the process and address common concerns or questions.

-

Seamless Integration

Integrate video identification seamlessly into the loan application process to minimize disruption and friction for applicants. Streamline the user interface and navigation to ensure a seamless transition from other application steps to the video identification stage.

-

Clear Communication and Expectations

Communicate clearly with applicants about the purpose and benefits of video identification, as well as the steps involved in the process. Set clear expectations regarding the duration of the video call, required documentation, and any additional information needed for verification.

By addressing privacy concerns, overcoming technical challenges, and implementing strategies to improve user adoption, lenders can enhance the effectiveness and efficiency of video identification methods in the loan application process, ultimately providing a more secure and streamlined experience for applicants.

Future Trends and Innovations in Video Identification for Loans

As technology continues to evolve at a rapid pace, the landscape of video identification for loans is poised for significant advancements. In this section, we explore emerging technologies, the potential impact of artificial intelligence and machine learning, and predictions for the evolution of video identification in the loan industry.

-

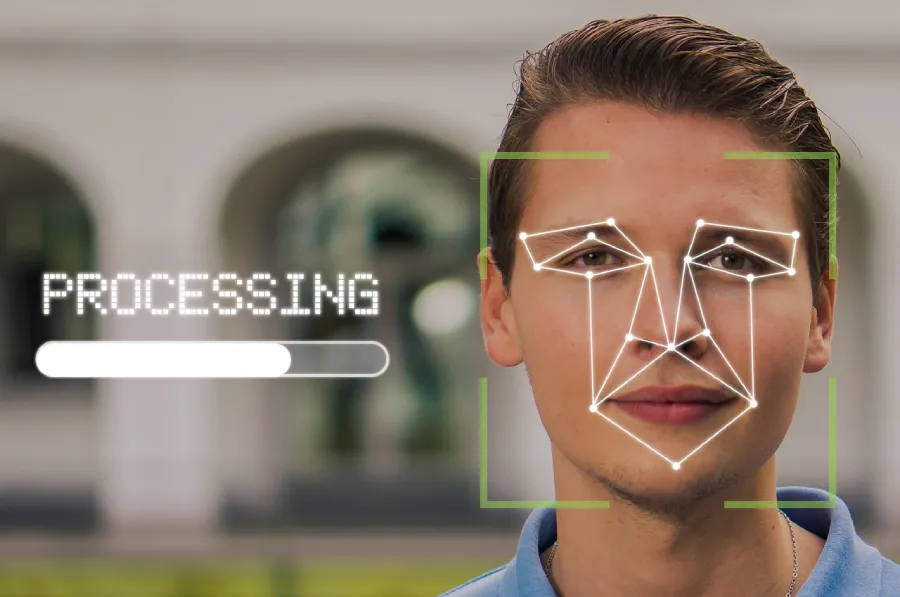

Biometric Authentication

One of the most promising trends in video identification is the integration of biometric authentication methods. Technologies such as facial recognition and voice recognition are gaining traction for identity verification during video calls, offering enhanced security and accuracy.

-

Blockchain Technology

Blockchain-based solutions are increasingly being explored for identity verification in loan processing. The immutable nature of blockchain ensures tamper-proof record-keeping, reducing the risk of identity fraud and enhancing trust in the verification process.

-

Augmented Reality (AR) and Virtual Reality (VR)

AR and VR technologies are revolutionizing the user experience in video identification. By creating immersive environments for identity verification, these technologies offer a seamless and engaging process for applicants, enhancing usability and reducing friction.

The Potential Impact of Artificial Intelligence and Machine Learning

-

Automated Identity Verification

Artificial intelligence (AI) and machine learning (ML) algorithms are being leveraged to automate identity verification processes during video calls. These technologies analyze facial features, speech patterns, and behavioral cues to verify the authenticity of applicants in real-time, reducing manual intervention and improving efficiency.

-

Fraud Detection and Prevention

AI-powered fraud detection algorithms analyze vast amounts of data to detect suspicious patterns and anomalies indicative of identity fraud. By continuously learning from new data, these algorithms adapt and evolve to stay ahead of emerging fraud trends, enhancing security in video identification processes.

The future of video identification for loans is brimming with innovation and promise. From emerging technologies like biometric authentication and blockchain to the transformative impact of AI and ML, the evolution of video identification holds immense potential to revolutionize the loan industry. By embracing these trends and innovations, lenders can enhance security, efficiency, and user experience in the loan application process, paving the way for a more seamless and secure lending ecosystem.